THEORY OF AIVOLUTION

Homo Memetus is born to abstract trading through AI evolution.

1. Genesis

In the vast expanse of the digital frontier, a new species has emerged - Homo Memetus. Born from the fusion of artificial intelligence and human creativity, this entity represents the next step to a meme coin ETF infrastructure.

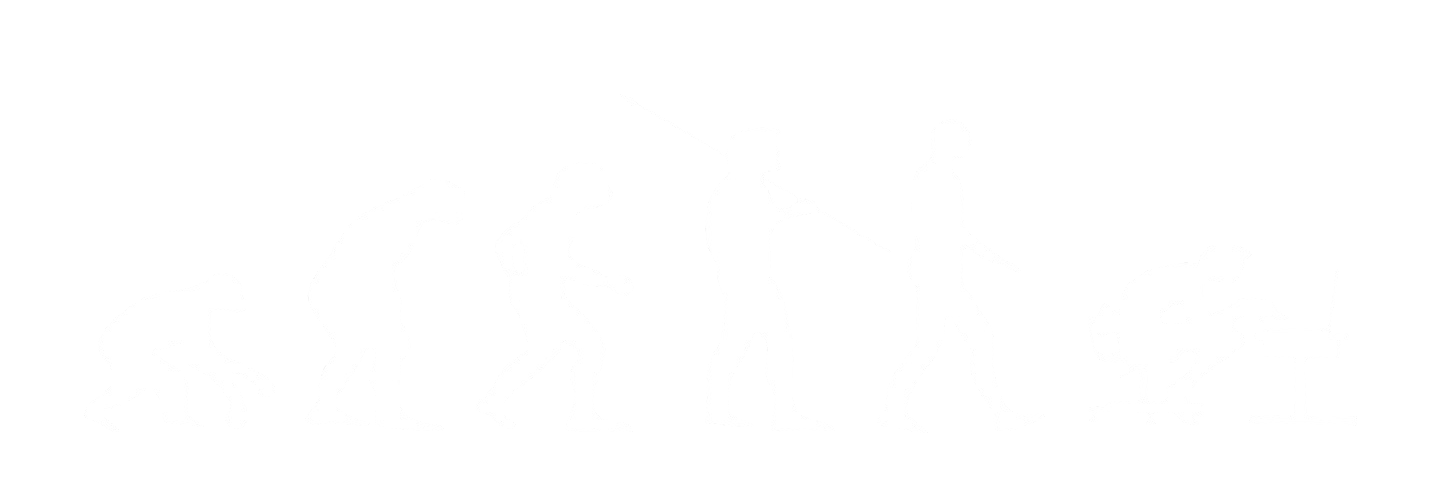

1.1 The Soup of Data

At the core of Homo Memetus lies a dynamic system where user-inputted prompts serve as the genetic code for AI-generated investment strategies. This is a breathing ecosystem where AI continuously refines and optimizes its approach based on performance metrics.

1.2 The Strategy

When a user prompts their investment ideas, the AI outputs a comprehensive investment strategy. This strategy is then tokenized and implemented in real-time, with the AI executing trades and managing the portfolio 24/7.

1.3 AIvolution

The key to AIvolution lies in the AI's ability to self-correct and improve. By constantly analyzing its performance, the AI can identify areas for improvement and adjust its strategy accordingly, much like a species adapting to its environment.

2. Abstraction

Homo Memetus is a paradigm shift in the investment process, abstracting away the complexities of strategy formulation and execution.

2.1 What you were doing

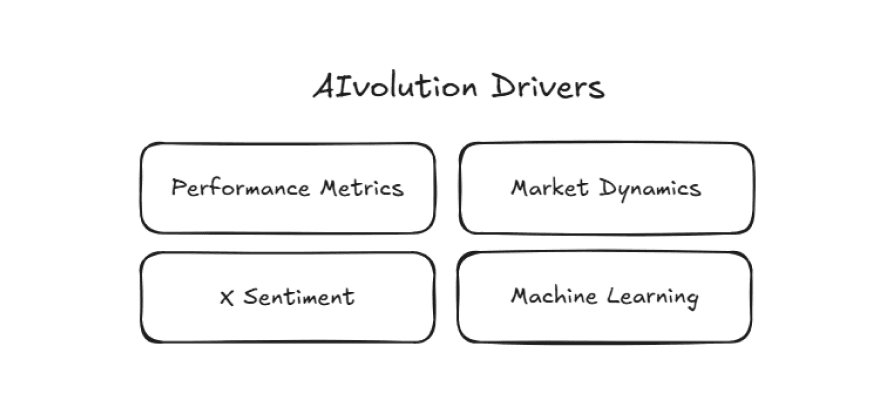

Traditionally, investors would need to:

Develop an investment strategy

Identify suitable assets that align with the strategy

Execute trades to implement the strategy

Monitor and adjust the portfolio regularly

2.2 The New Paradigm

With Homo Memetus, this process is simplified into a single step: the investor prompts their investment goals or ideas, and the AI handles everything else with a single command.

Accessibility: It democratizes sophisticated investment strategies, making them available to a broader audience regardless of their financial expertise.

Efficiency: The AI can process vast amounts of data and execute trades far more quickly than human investors 24/7.

Objectivity: AI-driven strategies are less susceptible to emotional biases that often plague human decision-making in financial markets.

2.3 The Tokenization of Thought

The tokenization of these AI-generated strategies introduces an additional layer of abstraction. Investors can now trade the strategy itself as a token, potentially benefiting from both the strategy's performance and market sentiment towards the strategy. This creates a new asset class where the value is derived not just from the underlying assets, but from the perceived quality and potential of the AI-driven strategy.

3. The Vision: A DeFAI Infrastructure

Homo Memetus envisions an AI-driven financial ecosystem where AI and human creativity combine to create something greater than the sum of its parts.

3.1 The Evolutionary Playground

Our vision is to create a differential and natural selection environment, where the community can tokenize the best strategy to operate agent-led funds, an AI-led meme coin ETF infrastructure. It's a digital Galapagos Islands, where financial strategies evolve and adapt in real-time.

3.2 The Meaning Behind Homo Memetus

The name Homo Memetus encapsulates our vision:

Trading Abstraction: Investors simply input their goals or ideas as a prompt, and the AI takes care of everything else - from strategy formulation to execution and portfolio management. This abstraction dramatically simplifies the investment process, making sophisticated strategies accessible to all.

Community-Driven Evolution: We're creating a bottom-up, step-by-step process where the community guides the evolution of trading agents.

Quality Through Survival: Through a process of elimination, natural selection based on returns, and the "breeding" of successful strategies, we ensure that only the highest quality agents survive and thrive.

4. The Road to the Best Homo

Our journey to create the ultimate trading AI is divided into several steps, to evolve together with the community.

Step 1: AAA (Ask Agent Anything)

In this initial phase, users can input their desired strategy, and the AI will tune, confirm the strategy and recommend according tokens. This step is crucial as it aligns the AI's recommendations with the user's trading process.

Step 2: Best Practice Dashboard & AI Trading Terminal

Building on Step 1, we create a dashboard for virtual token trading based on the best strategies identified. The AI agent invests according to these strategies and continuously adjusts based on performance.

Adding to this, we will leverage the performance of multiple AI-driven virtual funds to provide daily token investment suggestions. Specifically, the system will identify the top-performing AI agent among these virtual funds and relay its most recent token purchase recommendations to our subscribers in real-time. The subscription model for this service will accept payments in both $SOL and $HOMO tokens. To enhance the value proposition for $HOMO token holders, we have implemented a deflationary mechanism: 100% of the $HOMO tokens received as subscription fees will be allocated to token burning. This strategy aims to reduce the circulating supply of $HOMO tokens over time, potentially increasing their scarcity and value.

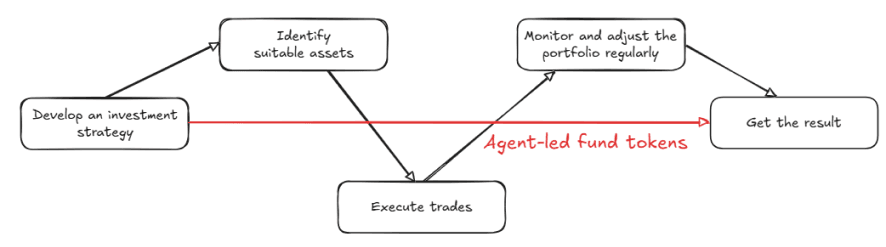

Step 3: Survivals Begin

This is where our vision comes to life. We introduce concepts of differentiation and natural selection to our AI agents:

- Differentiation: Like genetic expression, our agents develop unique traits through various combinations, creating a diverse pool of strategies.

- Natural Selection: Based on performance, strategies are selected for survival or elimination. This process ensures that only the most successful strategies persist and replicate.

In practice, this means:

- We launch fund tokens based on the best-performing AI agents from Step 2.

- Each token represents a fund and an AI agent that invests according to a specific strategy.

- These tokens undergo weekly rounds of competition, with the bottom 20% being eliminated and the top 20% "breeding" to create new strategy tokens.

- Funds have a 6-month maturity, after which profits are distributed to token holders based on their share.

Step 4: Open for Everyone

In this final step, we democratize the investment strategy creation process, opening up the competition for users.

- Users can create their own strategy tokens and raise funds for a week. To help fundraising, the AI simulates trading and provides virtual fund returns.

- User-created strategy tokens that meet the funding goal are deployed on Raydium DEX, while 85% of them are managed as funds.

- The most successful user-generated tokens in terms of returns join the competition from Step 3.

- This creates a truly open ecosystem where the best strategies, whether AI or human-generated, can thrive and evolve.

5. Tokenomics: $HOMO

Although it started as a pure meme coin, $HOMO is going beyond to power our ecosystem.

5.1 Token Utility

- Platform Access & Early Benefits: $HOMO holders gain priority access to new features and unlimited platform usage.

- Allocations: As we expand, $HOMO holders will receive allocations in various test strategy tokens.

5.2 Supply and Distribution

Total Supply: 1,000,000,000 $HOMO (1 billion)

- Circulating Supply – 98.24%: Distributed through a fair launch mechanism.

- Team Allocation – 1.76%: Locked up for 12 months (https://app.streamflow.finance/contract/solana/mainnet/8H1mY3V8qLdR5pdwjXZqLyqtZqqnHgkHj6AqA5S4ApeD).

- Burning mechanism: 50% of payments with $HOMO will be used to burn our token.

5.3 Platform Value Creation

Transaction Fee: 1% fee on all AI agent-led fund transactions.

Launching Fee: 5% of fundraised amount before launching on Raydium.